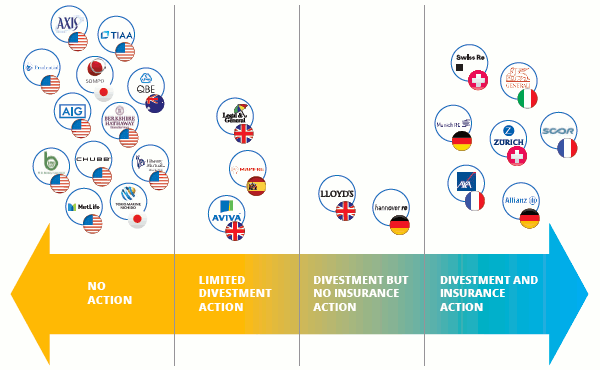

In the margins of the conference, Friends of the Earth France and Unfriend Coal published a report in which they rated and ranked the 24 largest insurers and reinsurers according to their level of commitment in the coal industry.

Insurers’ and reinsurers’ role in the coal industry

At the Paris Summit (COP 21) held three years ago, the 195 participating States committed themselves to the goal of limiting the rise in global temperature to 1.5 °C. To carry out this mission successfully, global coal production must be phased out by 59% by 2030 and totally abandoned by 2050.

At the Paris Summit (COP 21) held three years ago, the 195 participating States committed themselves to the goal of limiting the rise in global temperature to 1.5 °C. To carry out this mission successfully, global coal production must be phased out by 59% by 2030 and totally abandoned by 2050.

In practice, the wind is blowing in the opposite direction. The number of coal-fired power plants continues to grow. During the last three years, plants with a capacity of 92 GW have been built. Others, with a capacity of 672 GW, will emerge in the coming years. Currently, there are 1.380 new coal-fired power plants.

Insurers and reinsurers have the power to stop the unbridled evolution of this energy production mode. These financial players are acting in the coal sector at two levels - they insure coal risks and they make financial investments in the sector (taking equity interests in corporate capital). Yet, an uninsured project will never be funded. In addition, insurers and reinsurers are currently investing 31 trillion USD in the fossil fuel sector. Their decision to withdraw from high-carbon industries could make a big difference. This is the predominant trend today.

Unfriend Coal's 2017 campaign on insurance, coal and climate change showed that the world's largest insurers and reinsurers had reduced their investment in this fuel. Their divestment strategy is confirmed by the 2018 figures.

Ranking of insurers and reinsurers involved in the coal industry

| Company | Country | Coal Insurance | Coal Divestment | Other Climate Leadership | ||||

|---|---|---|---|---|---|---|---|---|

| Rank | Score | Rank | Assets* | Rank | Classement | Score | ||

Swiss Re | Swiss | 1 | 5.3 | 1 | 156 | 6.5 | 4 | 7.8 |

Generali | Italy | 2 | 3.9 | 6 | 581 | 4.2 | 7 | 5.2 |

Zurich | Swiss | 3 | 3.6 | 3 | 276 | 4.8 | 2 | 8.3 |

Allianz | Germany | 4 | 3.2 | 5 | 649 | 4.3 | 4 | 7.8 |

AXA | France | 5 | 2.5 | 2 | 1 723 | 5.7 | 1 | 8.7 |

SCOR | France | 6 | 1.7 | 3 | 18 | 4.8 | 7 | 5.2 |

Munich Re | Germany | 6 | 1.7 | 8 | 268 | 3.7 | 12 | 3.5 |

Mapfre | Spain | 8 | 0.7 | 10 | - | 2.3 | 17 | 1.3 |

Hannover Re | Germany | 9 | 0.0 | 7 | 64 | 4.0 | 16 | 1.7 |

Lloyd's | United Kingdom | 9 | 0.0 | 9 | 4 | 3.5 | 13 | 2.6 |

Aviva | United Kingdom | n/a | - | 11 | - | 1.7 | 2 | 8.3 |

Legal & General | United Kingdom | n/a | - | 12 | - | 0.4 | 6 | 6.1 |

QBE | Australia | 9 | 0.0 | 13 | - | 0.0 | 9 | 4.8 |

Sompo | Japan | 9 | 0.0 | 13 | - | 0.0 | 10 | 4.3 |

Tokio Marine | Japan | 9 | 0.0 | 13 | - | 0.0 | 11 | 3.9 |

Prudential | United States | n/a | - | 13 | - | 0.0 | 14 | 2.2 |

TIAA Family | United States | n/a | - | 13 | - | 0.0 | 14 | 2.2 |

AIG | United States | 9 | 0.0 | 13 | - | 0.0 | 18 | 0.9 |

Chubb | United States | 9 | 0.0 | 13 | 0.0 | 18 | 0.9 | |

MetLife | United States | n/a | - | 13 | - | 0.0 | 20 | 0.4 |

Axis Capital | United States | 9 | 0.0 | 13 | - | 0.0 | 21 | 0.0 |

W.R. Berkley | United States | 9 | 0.0 | 13 | - | 0.0 | 21 | 0.0 |

Berkshire Hathaway | United States | 9 | 0.0 | 13 | - | 0.0 | 21 | 0.0 |

Liberty Mutual | United States | 9 | 0.0 | 13 | - | 0.0 | 21 | 0.0 |

The maximum score for each column is 10.

* “Assets” refers to insurers’ assets covered by divestment policies.

Souce: The 2018 Scorecard on Insurance, Coal and Climate Change

European companies vs American companies

Souce: The 2018 Scorecard on Insurance, Coal and Climate Change