| DATE OF CREATION: 1966, Germany |

| CLASS OF BUSINESS: Life and non-life | |

| UNDERWRITING ZONE: Worldwide | |

| Regional structures: 41 offices in 28 countries |

Hannover Re: contact

| Address: Hannover Rück se, Karl-Weichert-Allee 50, 30625 Hannover, Germany |

| Tel: +49 511 5604-0 |

| Fax: +49 511 5604-1188 |

| Website: www.hannover-re.com |

Hannover Re: rating

| Agency | Rating | Outlook |

| Standard & Poor's | AA- | Stable |

| A.M. Best | A+ | Stable |

Hannover Re: main indicators

in thousands USD| 2018 | 2019 | 2020 | 2021 | |

| Turnover | 21 934 000 | 25 306 000 | 30 418 000 | 31 438 000 |

| Shareholder’s equity | 10 914 000 | 12 715 000 | 14 542 000 | 14 445 000 |

| Net result | 1 212 000 | 1 438 000 | 1 085 000 | 1 394 000 |

Read also | Hannover Re: 2022 quarterly results

Hannover Re: turnover 2021 by class of business

in thousands USD| Premiums | In % | |

| Property and casualty | 21 769 000 | 69.25% |

| Life and health | 9 669 000 | 30.75% |

| Total | 31 438 000 | 100% |

Hannover Re: technical ratios

| 2018 | 2019 | 2020 | 2021 | |

| Net loss ratio | 66.9% | 69.0% | 72.8% | 69.3% |

| Net management expenses ratio | 29.6% | 29.2% | 28.8% | 28.4% |

| Combined ratio | 96.5% | 98.2% | 101.6% | 97.7% |

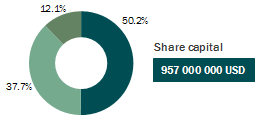

Hannover Re: capital and shareholding

| Shareholders | In % |  |

| Talanx | 50.2% | |

| Institutional investors | 37.7% | |

| Private investors | 12.1% |

Read also | Hannover Re: H1 2023 results

Hannover Re: management

| Jean-Jacques Henchoz | Chairman |

| Sven Althoff | Head of property & casualty reinsurance |

| Claude Chèvre | Head of life and health reinsurance department (Africa, Asia, Western and Southern Europe, Australia, etc) |

| Klaus Miller | Head of life and health reinsurance department (United Kingdom, North America, Central Europe, etc) |

| Clemens Jungsthöfel | Chief financial officer |

Sources: Hannover Re

Exchange rate as at 31/12/2020: 1 EUR = 1.22824 USD ; 31/12/2021: 1 EUR = 1.1324 USD