| DATE OF CREATION: 1972, Mumbai, India |

| CLASS OF BUSINESS: Life and non life | |

| UNDERWRITING ZONE: Worldwide | |

| REGIONAL STRUCTURES: 3 subsidiaries in South Africa, London and Moscow 3 branches in Dubai, Labuan and London 1 representative office in Brazil |

GIC Re : contact

| Contact: "Suraksha",170, Jamshedji Tata Road, Churchgate, Mumbai - 400 020, India |

| Tel: +91 22 2286 7000 |

| Email: info@gicofindia.com |

| Website: www.gicre.in |

GIC Re : rating

| Agency | Rating | Outlook |

| A.M Best | B++ | Stable |

GIC Re : main indicators

in thousands USD| 31/03/2021 | 31/03/2022 | |

| Turnover | 6 428 000 | 5 700 000 |

| Shareholder’s equity | 13 520 000 | 14 046 000 |

| Net result | 270 000 | 265 000 |

GIC Re : turnover as at 31/03/2022 by class of business

in thousands USD| Premiums | In % | |

| Fire | 1 708 290 | 29.97% |

| Motor | 1 285 350 | 22.55% |

| Agricultural risks | 1 043 670 | 18.31% |

| Health | 595 650 | 10.45% |

| Marine | 250 800 | 4.40% |

| Engineering | 185 820 | 3.26% |

| Aviation | 129 960 | 2.28% |

| Miscellaneous risks (1) | 308 940 | 5.42% |

| Total non life | 5 508 480 | 96.64% |

| Life | 191 520 | 3.36% |

| Total | 5 700 000 | 100% |

(1) Including and workmen's compensation, personal accident, TPL and credit

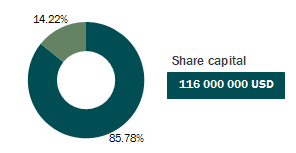

GIC Re : capital and shareholding

| Shareholders | In % |

| State of India | 85.78% |

| Institutional investors | 14.22% |

GIC Re : technical ratios

| 31/03/2021 | 31/03/2022 | |

| Net loss ratio | 92.40% | 93.21% |

| Net management expenses ratio | 19.63% | 18.87% |

| Net combined ratio | 112.03% | 112.08% |

GIC Re : management

| Shri Devesh Srivastava | Chairman and managing director |

| Jayashree Ranade | Chief financial officer |

| Rajesh Khadatare | Chief marketing officer (KMP) |

| Jayashri Balkrishna | Enterprise risk management, actuarial & data analytics |

| Balkrishna Variar | Chief underwriting officer |

| Radhika Ravishekar | Chief investment |

Exchange rate as at 31/03/2021: 1 INR = 0.01363 USD ; 31/03/2022: 1 INR = 0.01322 USD

Source: GIC Re